> -->

> -->

> -->

> -->

4月2日,中海商业受亚太房地产协会(APREA)参加国际网络研讨会,中海商业副总经理唐安琪女士代表中海商业,与包括ARA Asset、 Kailong group、 Asia Pacifc YARDI、China Orient Summit Capital等知名国际机构的资产管理行业领导者,共同探讨“Impact of the COVID-19 pandemic on china property market”。研讨会共吸引来自中国、新加坡、香港、印度、澳大利亚、美国和全球其他地区的超300名专业人士收听,获得广泛且良好的行业效应。

一、用投资的眼光看到经济环境的危机

随着SARS-CoV-2病毒在全球范围内的肆虐,全球经济正在迎接自全球金融危机以来最严重的衰退,针对宏观经济走势及对策分析问题,COOC中海商务认为目前的阶段类似延缓支出或需求节奏调整,崇邦集团CFO Chris Wu同样认可从投资前景的角度来看,疫情的爆发使买卖双方的预期将不匹配,可能需要几个月才能找到平衡。

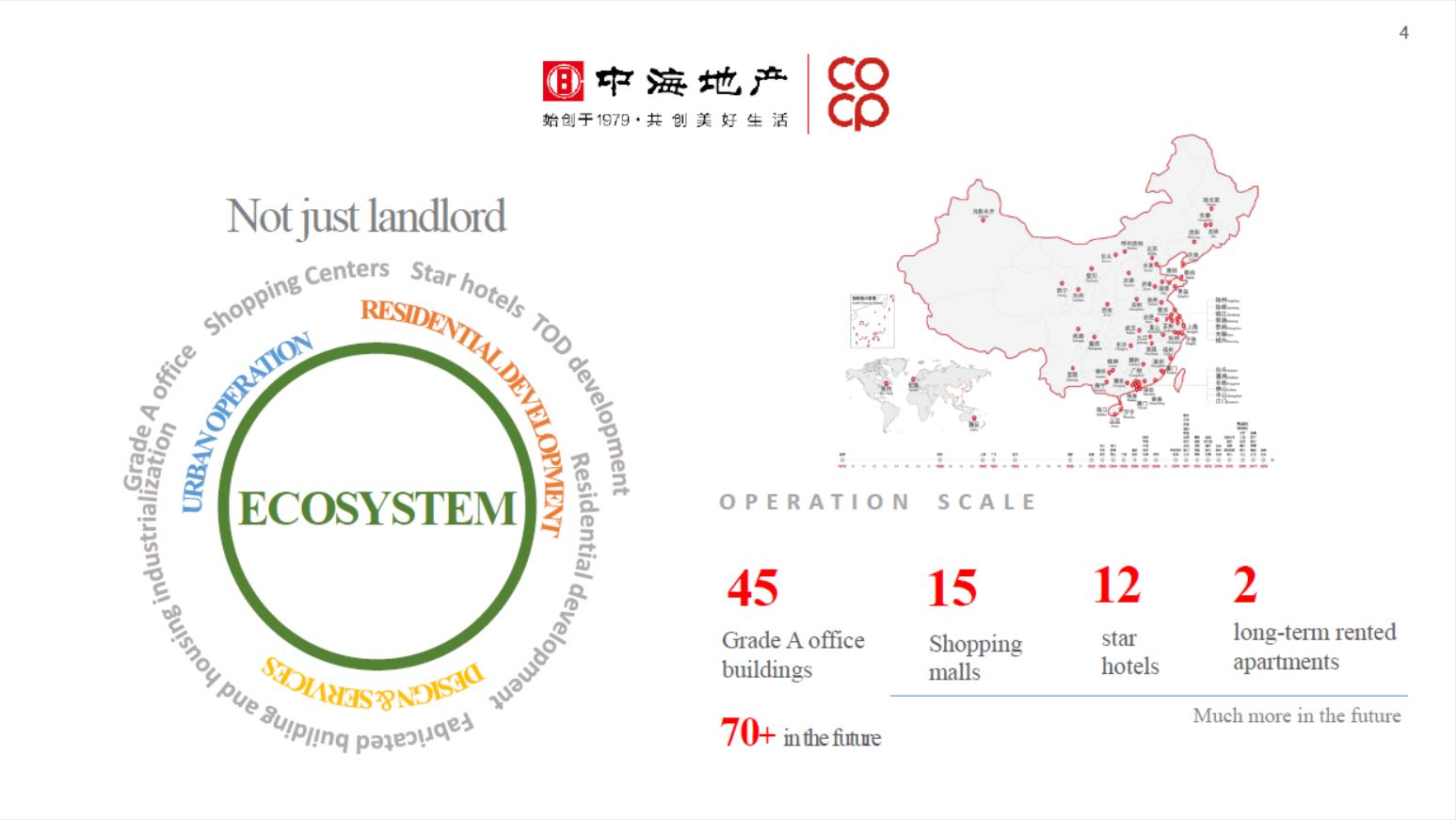

但随着欧美也逐步陷入这场健康与经济危机,相反的,COOC中海商务通过分享《COOC指数》中写字楼企业及员工复工情况,从一个角度展现了中国经济的积极复苏。在运营的27个城市,45余座甲级写字楼中,目前企业复工率为80%,员工复工率接近65%。该报告的一项租户调查中也进一步反应,虽然不应低估疫情带来的影响,但大多企业仍对长期发展前景充满信心。

凯龙瑞的创始人兼董事长郑喜明先生还认为,与大多数发展中经济体相比,中国的政策更具凝聚力,货币宽松空间也更大,因此中国将比大多数控制了病毒的主要经济体更好地度过危机。

二、以客户为中心的前瞻准备迎接复苏

面对复苏将很快到来,信心是最重要的!COOC同时提出未来具备潜力包括大健康、智能科技、新媒体等行业,资管方应提前做好租户结构优化及提前考虑资产包优化。

在洞悉防疫+积极复工复产的双核心需求下,中海商业旗下写字楼COOC中海商务在安全生产保障领域和身心健康领域持续进行着人性化实践,并利用中海商务经济生态圈的资源,提供Officloud中海云商系列服务,帮助企业安全、稳定、高效复工。

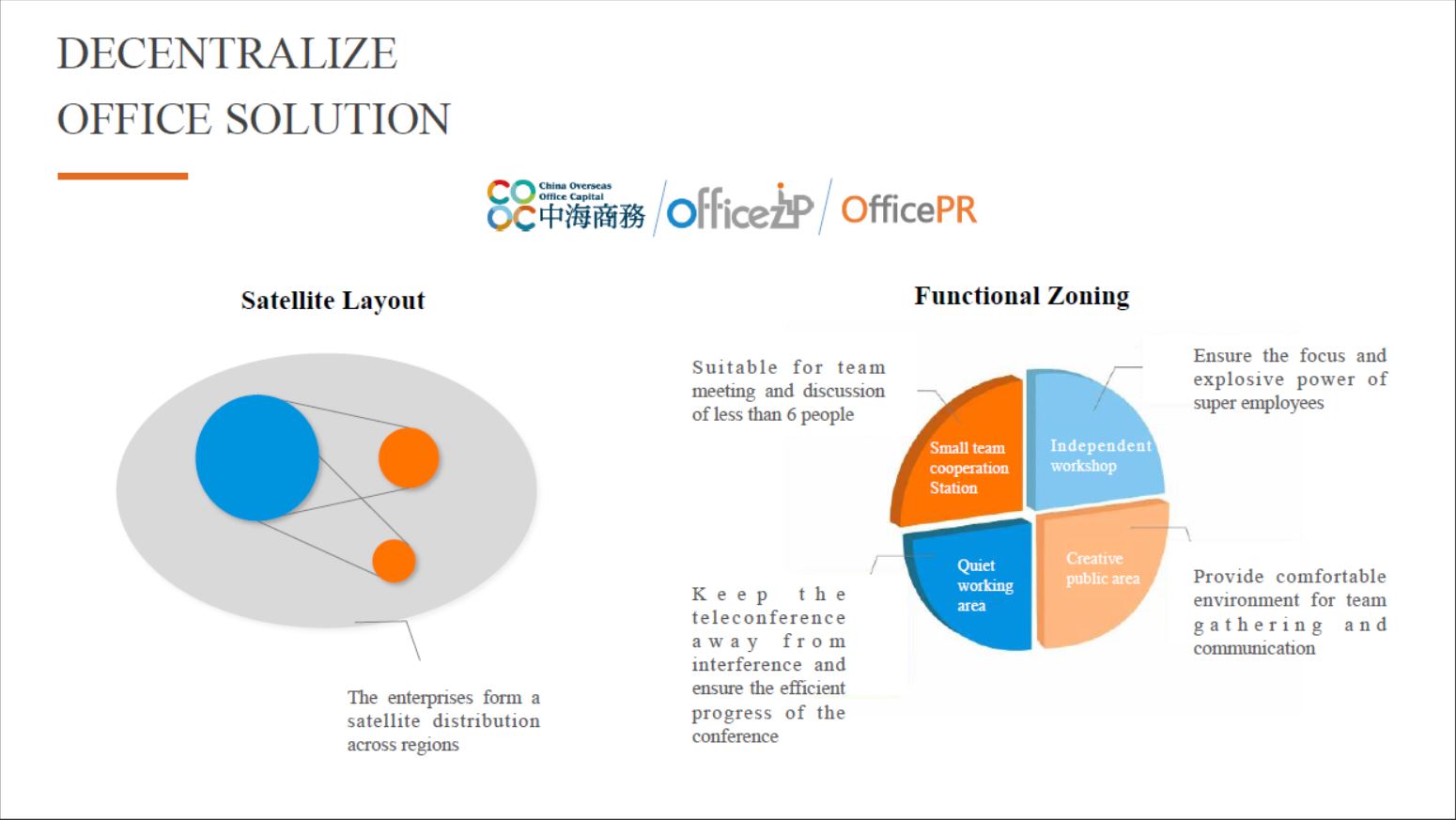

针对疫情期的员工用餐问题,推出放心餐服务;与银行、政府搭建桥梁,为短期现金流困难的中小微企业提供低门槛、低息租赁贷款和恢复生产贷款,并协助企业积极争取政府相应的资金补贴和扶持政策;而云招聘服务则通过“网上零距离求职”与“一站式招聘”推出覆盖所有租户的联合招聘平台,帮助企业招聘优秀人才;此外,还有与旗下自由办公品牌OFFICEZIP联合推出的分散化办公解决方案,使得租户保障疫情办公安全距离的同时,也获得更为灵活的办公体验。

COOC中海商务倡导从业者应重新审视目前的管理机制,从中寻求新的机会,强化以人为本、以客户为中心的经营理念,希望能借此时机,推动行业的向前发展。

三、办公趋势进化为共存共进

针对写字楼办公趋势影响的行业热点问题,面对疫情当中远程办公的爆发,COOC中海商务认为在经济结构不断调整的当下,各办公类型将会进化为共存共生的关系,但同时也需明确,写字楼是不可能被替代的!此次远程办公更进一步反映出了人们对于面对面交流、眼神交互的依赖性。COOC中海商务认为,办公空间作为企业生产经营重要组成部分,有着生产资料的特殊属性和功能,在某种程度上有着一定刚需的特征,而线下场景的近距离社交则能够更有效的帮助个人和企业提升工作与群体决策效率。而伴随此次疫情推动与社会、经济的发展,相应地,企业生产经营的上下游供应链、组织体系和生活方式在不断发生变化,对写字楼的需求也将带来变化,企业所逐步显现的跨地域的“卫星式分布”办公需求、企业不同部门的长短期“分散办公”需求、灵活办公的功能型空间需求等,都将引导企业重新考虑办公产品形势的多种组合方式。

对此,COOC中海商务已经建立了集约、多元的办公解决方案和办公空间产品,以传统办公空间为主的COOC甲级写字楼系列产品/灵活办公产品OFFICEZIP、精装修产品OfficePR、分散办公产品等,以其不同的优势服务不同的租户客群;其中甲级写字楼内交流互动和高效工作、决策属性,将始终是办公需求的主流。而此次疫情将加快促进绿色健康、优质运营将成为行业竞争者的核心优势。能够缩减企业运营效应成本的精装修和预装修产品OfficePRE,也将成为新的需求增长点。

COOC中海商务相信本次疫情的冲击将加快社会经济的转型,租户对环境安全、科技便利的敏感度将大幅提升,COOC中海商务也提前预知需求蓝海,已陆续在智能化、健康建筑领域发力,为全行业提供向前发展的方案模型。

四、消费和投资领域新观点

除了写字楼领域焦点以外,亚腾资产管理公司中国区总裁Alvin Loo以及崇邦集团CFO Chris Wu先生同样分享了零售和物流领域在此次疫情中的消费故事。尽管零售业是受封锁影响最严重的行业之一,面对网上消费的渗透“冲顶”,在后疫情期及经济发展复苏中,零售和物流将会成为一个更加令人信服的组合,其趋势会得到进一步加强。

东方藏山资产管理有限公司高级执行总裁陈李健先生指出房地产投资信托基金的审批程序前夕因疫情受到了影响。但房地产投资信托基金作为调动资本来源支持房地产行业的有效工具,对于中国机构投资者和高净值投资者来说,稳定创收资产仍然是一个有吸引力和可靠的资产类别,这将合理引导投资者,从而带来一个双赢的局面。

OVID-19 Disruption –

The Path Forward for China’s Property Market

5 Key Takeaways from APREA’s Webinar

1.Recovery to be protracted

As the SARS-CoV-2 infection beats a relentless march across the world, the global economy is bracing for the sharpest downturn since the Global Financial Crisis with some economists even conjecturing it could rival the Great Depression when the final impact is tallied. Hopes of a quick V-shaped recovery having all but evaporated in the past weeks and panelists on APREA’s latest webinar: COVID-19 Disruption – The Path Forward for China’s Property Market remain realistic. “I think it is going to be a long W shape,” said Chris Wu, Group CFO, Chongbang Group. The need to balance public health and safety will create a seesaw scenario even as the world claws back on output lost. In terms of the investment landscape, there will be mismatched expectations between buyers and sellers in the immediate aftermath of the pandemic, which will likely take a few months to find equilibrium. Hei Ming Cheng, Founder and Chairman, Kailong Group believes that investment volumes will remain depressed for the first half of the year. Travel restrictions are also hampering final negotiations and disclosed that deals KaiLong have been working on have also dragged for longer than usual. He expects some extent of cap rate expansion as income turns uncertain. “While interest rates will remain low, credit spreads will also expand as banks attach a higher risk premium into loans,” he said.

2.China best placed for economic rebound

With Europe and the U.S. now battling a health and economic crisis, China, being first in line on the infection front, is emerging albeit tentatively from a two-month lockdown. Chen Lijian, Chairman of APREA’s China Chapter and Senior Executive President, China Orient Summit Capital, noted that although the economy is now operating at 70-80% capacity, demand remains weak. Angel Tang, Deputy General Manager, China Overseas Commercial Properties shared that across its own managed office assets, comprising 45 buildings in over 27 cities, the current rate of resumption is 80% with the proportion of employees returning at close to 65%. She further revealed that in a tenant survey, while the impact should not be underestimated, companies remain confident of long-term prospects. Hei Ming also believes that China will weather the crisis better than most of the major economies having gained control of the virus after more than a two-month battle, as its policies are more cohesive and have more room for monetary accommodation as compared to most development economies. However, the most important attribute is the country’s sizeable middle class whose spending power is a critical economic pillar. “If the right policies curb unemployment and increase infrastructure investment, returning confidence will boost domestic consumption and lift economic growth,” he said.

3.China's consumption story continues to resonate

In an apparent nod to China’s rising middle class, Alvin Loo, Head of China, ARA Asset Management, revealed that the current crisis has not changed the firm’s mid-to-long term view of the country’s fundamentals. “We believe rising consumption driven by a growing middle-income class of up to 400 million in China to be one of the enduring investment themes of this decade,” he emphasized. Despite retail being one of the hardest hit sectors due to the lockdowns, he reiterates that strategically located and well-managed malls remains relevant to China’s consumption story. With the switch towards online purchases, which will likely accelerate from the pandemic, also reinforces investments into logistics properties. Alvin revealed that this is precisely what ARA is banking on, with the firm’s acquisition of a majority stake in logistics real estate developer and fund manager, Logos Group, which boasts a A$8 billion worth of AUM. Chris readily agrees, citing that online penetration and usage by over-55 year-olds have “gone through the roof”. He further reveals that Chongbang’s venture with Hema, Alibaba’s brick-and-mortar supermarket that blends online and offline retail, which allows them to ride on its logistics capability to fulfil online orders from its LifeHubs retail concepts across China. Chris noted that retail and logistics is a compelling mix whose trend will only be further reinforced in the post-pandemic environment.

4.REITs' role remains important in the post-pandemic investment landscape

Lijian, in posing the question of the role of REITs, which for years have been eagerly anticipated in China, informed that the country’s National Development and Reform Commission with Securities Regulatory Commission have finished the approval process for pilot REITs, after which progress was halted by the outbreak. Alvin notes that investments will be an important tool to sustain and propel an economic recovery after the pandemic, and REITs are an effective vehicle at mobilizing capital sources to support the real estate sector. While liquidity will be abundant from the extraordinary stimulus efforts seen so far, other countries, particularly top city locations in Europe and the U.S. will also compete for funds in the post-pandemic environment. “The number of attractive and distressed yields emerging in these locations could prove compelling,” he noted. As it is likely that investors based there will have the upper hand, and stabilize income producing asset remains an attractive and dependable asset class for both Chinese institutional and high net worth investors which will help channel investors away from the more speculative residential market and riskier financial products. “It will be a win-win situation for all,” he said.

5. Creative space solutions crucial post pandemic

The infection has sped acceptance of agile workspaces and no doubt redefine ongoing trends in remote working as well as share workspaces. How will landlords cope in this post-pandemic environment? Angel states that, as their firm continues to render assistance to tenants along with the gradual resumption of work, occupiers will no doubt rethink the configurations between traditional and agile workspaces. “The proportion of different office spaces, from conventional to flexible, will vary between periods,” she said. As a landlord which has been making great efforts to build ecosystem in the office buildings, China Overseas Commercial has established a suite of workspace solutions including decentralized ones in over 27 cities. However, she does not think that office buildings will be replaced. “If anything, this pandemic could well reinforce how important offices are,” she emphasized. “It is only human nature to crave and rely on social interaction for decision-making efficiency.” However, she observed that operational capabilities will become a core competency, as tenants pay more attention to the technology and environment in office buildings that promotes the well-being for their employees. She highlights force majeure clauses as an important trend that will become evident in office leases after the infection. “The agreements may be more specific in the leasing contract after this pandemic,” she said.